On october 1 a client pays a company 12000 – On October 1, a client pays a company $12,000, marking a significant transaction that warrants careful examination. This transaction holds implications for both parties, influencing their financial statements, tax liabilities, and business operations. Delving into the details of this transaction, we will explore its accounting treatment, tax consequences, and broader business implications.

The nature of the payment, whether for goods, services, or other purposes, will shape the accounting treatment and tax implications. Understanding these nuances is crucial for both the client and the company to ensure compliance and optimize their financial positions.

Transaction Overview

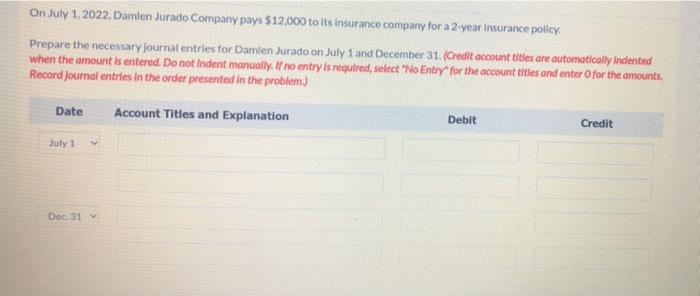

On October 1, a client made a payment of $12,000 to a company. The payment was for services rendered by the company.

Accounting Impact

For the client, the payment would be recorded as an expense. For the company, the payment would be recorded as revenue.

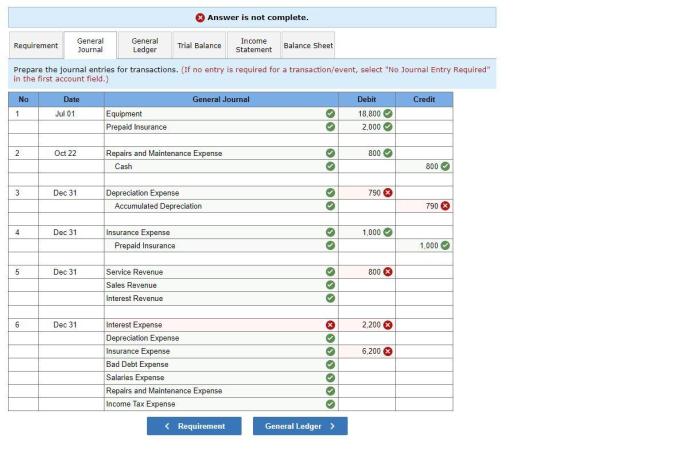

Journal Entries, On october 1 a client pays a company 12000

- Client: Debit Expense $12,000, Credit Cash $12,000

- Company: Debit Cash $12,000, Credit Revenue $12,000

The transaction would have the following impact on the financial statements:

- Balance Sheet: The client’s cash balance would decrease by $12,000, and the company’s cash balance would increase by $12,000.

- Income Statement: The client’s expenses would increase by $12,000, and the company’s revenue would increase by $12,000.

Tax Implications: On October 1 A Client Pays A Company 12000

The payment may be subject to sales tax, depending on the jurisdiction in which the transaction takes place. The client may be responsible for withholding income tax from the payment if the company is not located in the same jurisdiction as the client.

Both the client and the company should consult with their tax advisors to determine the specific tax implications of the transaction.

Business Implications

The transaction may have the following business implications:

- For the client: The payment may reduce the client’s cash flow and profitability.

- For the company: The payment may increase the company’s cash flow and profitability.

- For both parties: The transaction may strengthen the business relationship between the client and the company.

Industry Benchmarks

Industry benchmarks for similar transactions can vary depending on the specific industry and the size of the companies involved.

In general, the payment terms for services rendered typically range from 30 to 60 days. The discount rate for early payment may range from 1% to 3%.

FAQ Overview

What is the significance of the October 1 transaction?

The October 1 transaction represents a financial exchange between a client and a company, potentially impacting their financial statements, tax liabilities, and business operations.

How does the nature of the payment affect the transaction’s treatment?

The nature of the payment (goods, services, or other purposes) determines the appropriate accounting treatment and tax implications for both the client and the company.

What are the potential tax consequences of the transaction?

The transaction may be subject to sales tax, income tax, or other taxes, depending on the specific circumstances. Both parties must understand their tax reporting requirements to ensure compliance.