Benson has a bankruptcy on his credit report – Benson’s credit report bears the weight of a bankruptcy, a financial setback that can have far-reaching consequences. This analysis delves into the potential impact on his credit score, lending prospects, and emotional well-being, while providing guidance on rebuilding credit and navigating the legal implications.

Understanding the complexities of bankruptcy’s impact on Benson’s financial life is crucial for informed decision-making and charting a path toward financial recovery.

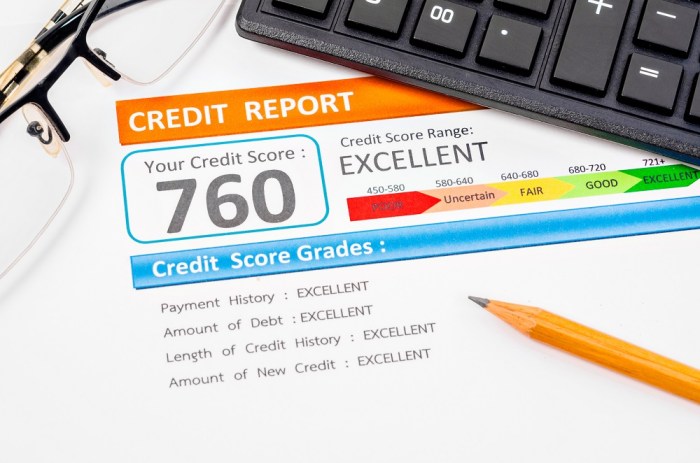

Impact on Credit Score

A bankruptcy can have a significant negative impact on Benson’s credit score. Bankruptcy information remains on credit reports for up to 10 years, which can affect his ability to obtain loans, credit cards, and other forms of credit in the future.

The severity of the impact depends on several factors, including:

- The type of bankruptcy filed (Chapter 7 or Chapter 13)

- The number of bankruptcies filed

- The length of time since the bankruptcy was discharged

- Benson’s overall credit history

For example, a Chapter 7 bankruptcy typically has a more negative impact on a credit score than a Chapter 13 bankruptcy. Additionally, multiple bankruptcies or recent bankruptcies can have a more severe impact than a single bankruptcy that occurred several years ago.

Consequences for Lending

A bankruptcy can make it more difficult for Benson to obtain loans, especially unsecured loans such as personal loans or credit cards. Lenders are more likely to view Benson as a higher risk borrower due to his bankruptcy history, which can result in higher interest rates or even denial of credit.

Some types of loans, such as mortgages, may be particularly difficult to obtain after a bankruptcy.

To improve his chances of loan approval, Benson should consider the following:

- Waiting several years after the bankruptcy discharge before applying for new credit

- Building a strong credit history by making on-time payments and keeping his credit utilization low

- Providing a detailed explanation of the circumstances that led to the bankruptcy

- Offering collateral or a co-signer to reduce the lender’s risk

Rebuilding Credit

Rebuilding credit after a bankruptcy takes time and effort. Benson should focus on the following steps:

- Obtain a secured credit card or credit-builder loan to start building a positive credit history

- Make all payments on time, every time

- Keep his credit utilization low (ideally below 30%)

- Avoid opening too many new credit accounts in a short period of time

- Dispute any errors on his credit report

Rebuilding credit can take several years, but by following these steps, Benson can gradually improve his credit score and regain access to credit.

Legal Implications

A bankruptcy can have significant legal implications for Benson’s financial situation. The bankruptcy court will review his assets, debts, and future earnings to determine how much of his debt can be discharged. In some cases, Benson may be required to liquidate assets to pay off creditors.

Bankruptcy can also impact Benson’s future earnings. For example, if he files for Chapter 13 bankruptcy, he may be required to make regular payments to creditors for several years. Additionally, a bankruptcy can make it more difficult to obtain certain types of professional licenses or government benefits.

To protect his legal rights, Benson should consult with an attorney who specializes in bankruptcy law.

Emotional Impact

A bankruptcy can have a significant emotional impact on Benson. He may feel shame, embarrassment, and anxiety about his financial situation. He may also worry about how the bankruptcy will affect his future financial prospects.

It is important for Benson to remember that he is not alone. Many people have filed for bankruptcy and have successfully rebuilt their financial lives. He should seek support from friends, family, or a therapist to help him cope with the emotional challenges of bankruptcy.

FAQ: Benson Has A Bankruptcy On His Credit Report

How significantly will Benson’s credit score be affected by the bankruptcy?

The impact on Benson’s credit score depends on several factors, including the type of bankruptcy filed, his previous credit history, and the scoring model used. Typically, a bankruptcy can result in a significant drop in credit score, which can take several years to recover from.

Will Benson be denied credit entirely due to the bankruptcy?

While a bankruptcy may make it more challenging to obtain certain types of credit, such as unsecured loans or credit cards, it does not necessarily mean Benson will be denied credit altogether. Lenders may consider other factors, such as his income, employment history, and post-bankruptcy financial management, when making lending decisions.

What steps can Benson take to rebuild his credit after bankruptcy?

Rebuilding credit after bankruptcy requires patience and responsible financial management. Benson should start by obtaining a copy of his credit report to identify any errors and begin making all payments on time. He should also consider using a secured credit card or credit-builder loan to establish a positive payment history.

What are the legal implications of bankruptcy for Benson?

Bankruptcy has several legal implications, including the discharge of certain debts, the potential sale of assets, and the impact on future earnings. Benson should consult with an attorney to fully understand his legal rights and responsibilities during the bankruptcy process.