Beth taps her phone at a payment, marking a pivotal moment in the evolution of the payments industry. This innovative technology has introduced a seamless, secure, and convenient way to transact, reshaping the way consumers and merchants interact.

As we delve into the world of payment taps, we will explore its intricate workings, examine its impact on the user experience, and analyze its implications for the payments industry as a whole. Join us on this captivating journey as we uncover the transformative power of beth taps her phone at a payment.

Overview of Payment Tap Functionality

Payment tap, also known as contactless payment or tap-to-pay, is a technology that enables consumers to make payments by tapping their payment devices (such as smartphones, smartwatches, or dedicated contactless cards) on a contactless payment terminal.

This technology utilizes near-field communication (NFC), a wireless communication protocol that allows two devices to exchange data over short distances (typically within a few centimeters).

Hardware and Software Components

Tap-to-pay systems consist of the following hardware and software components:

- Payment device:A smartphone, smartwatch, or contactless card with an embedded NFC chip.

- Contactless payment terminal:A point-of-sale (POS) device equipped with an NFC reader.

- Payment application:A software application installed on the payment device that stores payment information and facilitates the transaction.

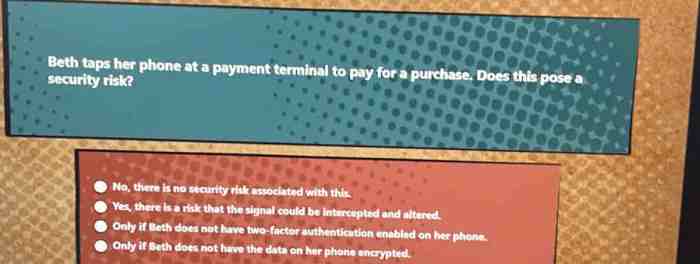

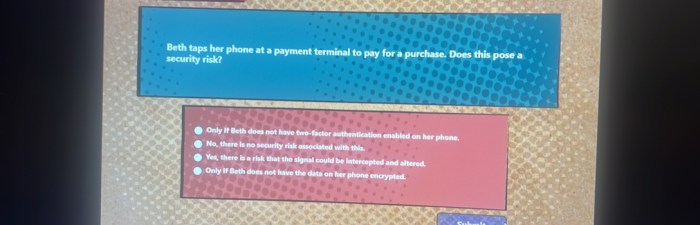

Security Measures, Beth taps her phone at a payment

To ensure the security of tap-to-pay transactions, several security measures are implemented:

- Encryption:All data transmitted during the transaction is encrypted to prevent eavesdropping.

- Tokenization:Payment information is replaced with a unique token that is specific to the transaction, reducing the risk of data theft.

- Transaction limits:Some systems impose transaction limits to minimize the potential impact of unauthorized transactions.

User Experience with Payment Taps: Beth Taps Her Phone At A Payment

Payment taps offer a convenient and secure method of making transactions. However, it is crucial to understand the user experience associated with this technology to identify potential pain points and areas for improvement.

The typical user journey for a tap-to-pay transaction involves several steps:

- The user selects the desired payment method on their mobile device.

- The device is held near the payment terminal, typically within a few centimeters.

- The terminal detects the device and establishes a secure connection.

- The payment information is transmitted wirelessly to the terminal.

- The transaction is authorized and completed.

While payment taps generally provide a seamless experience, several factors can lead to potential pain points and frustrations for users:

- Connection issues:Poor network connectivity or hardware malfunctions can disrupt the connection between the device and the terminal, causing delays or transaction failures.

- Device compatibility:Not all mobile devices are compatible with tap-to-pay technology, which can limit the accessibility of this payment method for some users.

- User errors:Incorrect device placement or improper handling can result in failed transactions, leading to frustration and inconvenience for users.

- Security concerns:Users may have concerns about the security of tap-to-pay transactions, particularly regarding the potential for unauthorized access to their financial information.

To improve the user experience with payment taps, several suggestions can be considered:

- Enhance connectivity:Implement robust communication protocols and optimize network infrastructure to ensure stable connections between devices and terminals.

- Promote device compatibility:Collaborate with device manufacturers to ensure widespread compatibility with tap-to-pay technology, making it accessible to a broader user base.

- Simplify user interface:Design intuitive and user-friendly interfaces that provide clear instructions and minimize the risk of user errors.

- Address security concerns:Implement robust security measures and educate users about the safeguards in place to protect their financial information.

By addressing these pain points and incorporating these suggestions, businesses and payment providers can enhance the user experience with payment taps, making them more convenient, reliable, and secure for consumers.

Merchant Acceptance of Payment Taps

The widespread adoption of contactless payment technologies has prompted merchants to consider the benefits and challenges of accepting tap-to-pay payments. This section explores the advantages and potential obstacles associated with tap-to-pay acceptance, examines the various types of tap-to-pay terminals available, and provides guidance on optimizing the tap-to-pay acceptance process for merchants.

Benefits of Tap-to-Pay Acceptance

- Enhanced Customer Convenience:Tap-to-pay payments offer customers a seamless and speedy checkout experience, reducing wait times and improving overall satisfaction.

- Increased Transaction Speed:Tap-to-pay eliminates the need for card insertion or PIN entry, significantly accelerating transaction processing times.

- Reduced Fraud Risk:Contactless payments utilize EMV chip technology, which enhances security and reduces the risk of fraud compared to traditional magnetic stripe cards.

- Improved Hygiene:Tap-to-pay payments minimize physical contact between customers and checkout staff, promoting better hygiene practices.

- Increased Sales:Faster transaction times and reduced checkout queues can lead to increased customer throughput and potential sales growth.

Challenges of Tap-to-Pay Acceptance

- Cost of Implementation:Merchants may incur upfront costs associated with acquiring and installing tap-to-pay terminals.

- Compatibility Issues:Ensuring compatibility between tap-to-pay terminals and various payment platforms and devices can be a technical challenge.

- Limited Acceptance:While tap-to-pay acceptance is growing, it may not be universally available, potentially limiting customer convenience.

- Security Concerns:Merchants must implement robust security measures to protect customer data and prevent fraudulent transactions.

Types of Tap-to-Pay Terminals

Merchants can choose from a range of tap-to-pay terminals to meet their specific needs:

- Fixed Terminals:These terminals are typically countertop-mounted and designed for high-volume transactions.

- Mobile Terminals:These portable terminals allow merchants to accept tap-to-pay payments anywhere, increasing flexibility.

- Integrated Terminals:These terminals are integrated with existing point-of-sale systems, providing a seamless payment experience.

Optimizing Tap-to-Pay Acceptance

To optimize tap-to-pay acceptance, merchants can consider the following steps:

- Educate Staff:Train staff on the proper use of tap-to-pay terminals and security protocols.

- Promote Tap-to-Pay Options:Display clear signage and inform customers about the availability of tap-to-pay payments.

- Maintain Terminals:Regularly update and maintain tap-to-pay terminals to ensure optimal performance and security.

- Monitor Transactions:Track tap-to-pay transactions to identify any suspicious activity or areas for improvement.

Impact of Payment Taps on the Payments Industry

The advent of tap-to-pay technology has had a profound impact on the traditional payment landscape, revolutionizing the way consumers make purchases. This transformative technology has implications for cash, cards, and other payment methods, while also driving innovation in the payments industry.

Tap-to-pay technology, often referred to as contactless payment or near-field communication (NFC), allows consumers to make payments by simply tapping their smartphone or contactless card on a payment terminal. This eliminates the need for physical contact between the payment device and the terminal, providing a faster, more convenient, and more secure payment experience.

Impact on Cash

The widespread adoption of tap-to-pay technology has led to a decline in the use of cash. Consumers find it more convenient to tap their phone or card rather than fumble with coins or bills. This shift away from cash has implications for businesses, as they may need to adjust their payment systems to accommodate the increasing use of contactless payments.

Impact on Cards

Tap-to-pay technology has also impacted the use of traditional payment cards. While cards are still widely used, tap-to-pay offers a more seamless and secure payment experience. As a result, some consumers are opting to use their smartphones or other contactless devices as their primary payment method, reducing the need for physical cards.

Driving Innovation

The advent of tap-to-pay technology has spurred innovation in the payments industry. Businesses are exploring new ways to integrate contactless payments into their operations, such as self-checkout kiosks and mobile ordering systems. Additionally, tap-to-pay technology has opened up new possibilities for mobile payments, such as peer-to-peer payments and mobile wallets.

Future Trends in Payment Taps

Payment tap technology is rapidly evolving, with new advancements emerging continuously. These advancements have the potential to further enhance the convenience, security, and accessibility of tap-to-pay payments.

One significant trend is the integration of biometric authentication into payment taps. Biometric authentication, such as fingerprint or facial recognition, provides a highly secure and convenient way to verify a user’s identity. By incorporating biometrics into payment taps, consumers can eliminate the need for PINs or passwords, making the payment process even faster and more seamless.

Wearable Devices

Wearable devices, such as smartwatches and fitness trackers, are becoming increasingly popular, and they are also being integrated with payment tap functionality. This allows consumers to make payments conveniently without having to carry their smartphones or wallets. Wearable payment taps are particularly well-suited for situations where carrying a phone or wallet is inconvenient, such as during exercise or when traveling light.

Other Innovations

Other innovative technologies that are being explored for payment taps include near-field communication (NFC) rings, stickers, and key fobs. These devices allow consumers to make payments by simply tapping them on a compatible payment terminal. This provides even greater convenience and flexibility, as consumers can choose the payment tap device that best suits their needs and preferences.

Future Implications

The future of payment taps is bright, with numerous advancements and innovations on the horizon. These advancements have the potential to revolutionize the way consumers make payments, providing greater convenience, security, and accessibility. As payment tap technology continues to evolve, it is likely to become even more widely adopted by consumers, merchants, and the payments industry as a whole.

FAQ Resource

How does beth taps her phone at a payment work?

Beth taps her phone at a payment by utilizing near-field communication (NFC) technology. When her phone is brought into close proximity with a payment terminal, the NFC chip in her phone communicates with the terminal, securely transmitting payment information.

Is beth taps her phone at a payment secure?

Yes, beth taps her phone at a payment is highly secure. NFC technology uses strong encryption to protect sensitive payment data, and most mobile payment apps require additional authentication, such as a fingerprint or PIN, to complete a transaction.