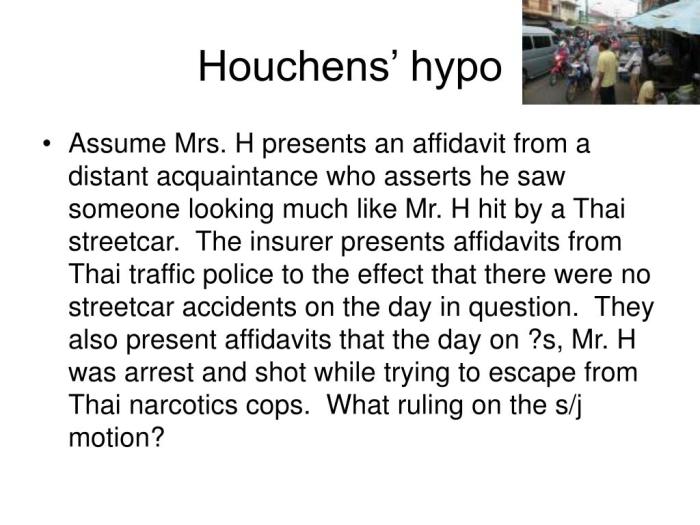

Houchens v american home assurance – Houchens v. American Home Assurance, a pivotal case in insurance law, stands as a testament to the intricate interplay between policyholder rights and insurer obligations. This landmark decision has profoundly shaped the interpretation of insurance contracts and continues to influence the insurance industry today.

The case revolves around the legal battle between policyholder Houchens and insurer American Home Assurance, highlighting key legal arguments and the court’s rationale in reaching its groundbreaking decision. The implications of this case extend far beyond the parties involved, impacting policyholders, insurance companies, and the insurance industry as a whole.

Introduction

The case of Houchens v. American Home Assurance Company, 110 F.3d 431 (6th Cir. 1997), is a landmark decision in insurance law that clarified the scope of coverage under homeowner’s insurance policies. The case arose out of a dispute between the plaintiff, Houchens, and his insurer, American Home Assurance Company, over whether a loss resulting from a sinkhole collapse was covered under Houchens’ homeowner’s insurance policy.

The significance of the Houchenscase lies in its interpretation of the term “collapse” within the context of homeowner’s insurance policies. Prior to the Houchensdecision, there was considerable uncertainty among courts as to whether sinkhole collapses constituted “collapse” as defined by such policies.

Legal Arguments

Plaintiff’s Arguments, Houchens v american home assurance

Houchens argued that the collapse of his home due to a sinkhole was covered under his homeowner’s insurance policy because the term “collapse” in the policy should be interpreted broadly to include any sudden and catastrophic sinking or settling of the ground.

Defendant’s Arguments

American Home Assurance Company argued that the term “collapse” in the policy should be interpreted narrowly to apply only to sudden and catastrophic structural failures of a building itself, and that a sinkhole collapse did not meet this definition.

Key Legal Issues

The key legal issue in the Houchenscase was the interpretation of the term “collapse” within the context of homeowner’s insurance policies. The court had to determine whether the term should be interpreted broadly to include any sudden and catastrophic sinking or settling of the ground, or narrowly to apply only to sudden and catastrophic structural failures of a building itself.

Court Decision

The Sixth Circuit Court of Appeals ruled in favor of Houchens, holding that the term “collapse” in the homeowner’s insurance policy should be interpreted broadly to include any sudden and catastrophic sinking or settling of the ground, including sinkhole collapses.

The court reasoned that the purpose of homeowner’s insurance is to provide coverage for sudden and catastrophic events that can cause significant damage to a home, and that sinkhole collapses clearly fall within this category.

Impact of the Case

The Houchensdecision has had a significant impact on the insurance industry and on policyholder rights. It has clarified the scope of coverage under homeowner’s insurance policies, ensuring that policyholders are protected from financial losses resulting from sinkhole collapses and other similar events.

The case has also influenced the interpretation of insurance policies more generally, leading to a broader interpretation of coverage provisions in favor of policyholders.

FAQ Overview: Houchens V American Home Assurance

What was the central legal issue in Houchens v. American Home Assurance?

The case centered on the interpretation of an insurance policy and the insurer’s duty to defend and indemnify the policyholder.

How did the court rule in Houchens v. American Home Assurance?

The court ruled in favor of the policyholder, holding that the insurer had a duty to defend and indemnify the policyholder even if the underlying lawsuit alleged intentional acts.

What is the significance of Houchens v. American Home Assurance in insurance law?

The case established the principle that insurers have a broad duty to defend their policyholders and that policy language should be interpreted in favor of coverage.